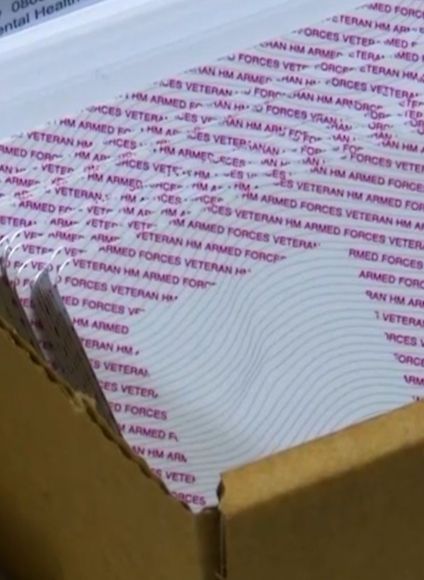

Get The Recognition You Deserve: Apply For Your Veteran Card

The Veteran card is now available following the work from The Ministry of Defence and The Office for Veterans’ Affairs. Find out more here.

Learn MoreWelcome to Trinity’s Info Hub. A hub of useful information for regulars, transitioning personnel and veterans.

The Veteran card is now available following the work from The Ministry of Defence and The Office for Veterans’ Affairs. Find out more here.

Learn More

From protecting against wealth loss to ensuring a quick payout, getting your will sorted is crucial if you are in the armed forces. Read our 3 minute guide here

Learn More

With 64% of those serving in the military owning a home, renting your property may be something worth considering if you are deployed overseas. Read our latest guide for advice on military mortgages and renting out your home

Learn More

If you live in service provided accommodation you are liable for any damage to your SFA or SLA. Discover the importance of Licence to Occupy Insurance here.

Learn More

The New Accommodation Offer from the MOD was announced in Sept 2023. But what is it, and who is eligible? Find answers to this, and other FAQs, here.

Learn More

In this guide, we'll explore the top insurance products designed to provide peace of mind and financial security for army personnel, their families, and veterans.

Learn More